The recently concluded Futures Spring Tournament was a resounding success. Overall, the 15-day tournament attracted over 140,000 traders worldwide with over 580 participating teams. It was exciting to have traders of various backgrounds and experiences participate in the tournament to test their trading skills.

The tournament brought together some of the best crypto traders globally – all competing for the grand prize of $1.6 million worth of BNB.

As the tournament ended, we interviewed some of the top traders and learned the secrets to their trading success. Specifically, we learned more about their trading style, strategies, and their psychological approach to trading. Our top traders also shared their best and worst trading experiences in the interview, giving you an insight into the dos and don’ts of crypto trading. Without further ado, below are the main pieces of advice shared by the tournament’s top traders.

1. Develop Your Trading Methodology

Every trader is unique – each with its own methodologies, risk tolerance, and time horizons. All successful traders have a working method to analyze the markets – from intra-day trading to long-term position trading. In the interview with our top traders, we discovered that they have a well-defined trading methodology.

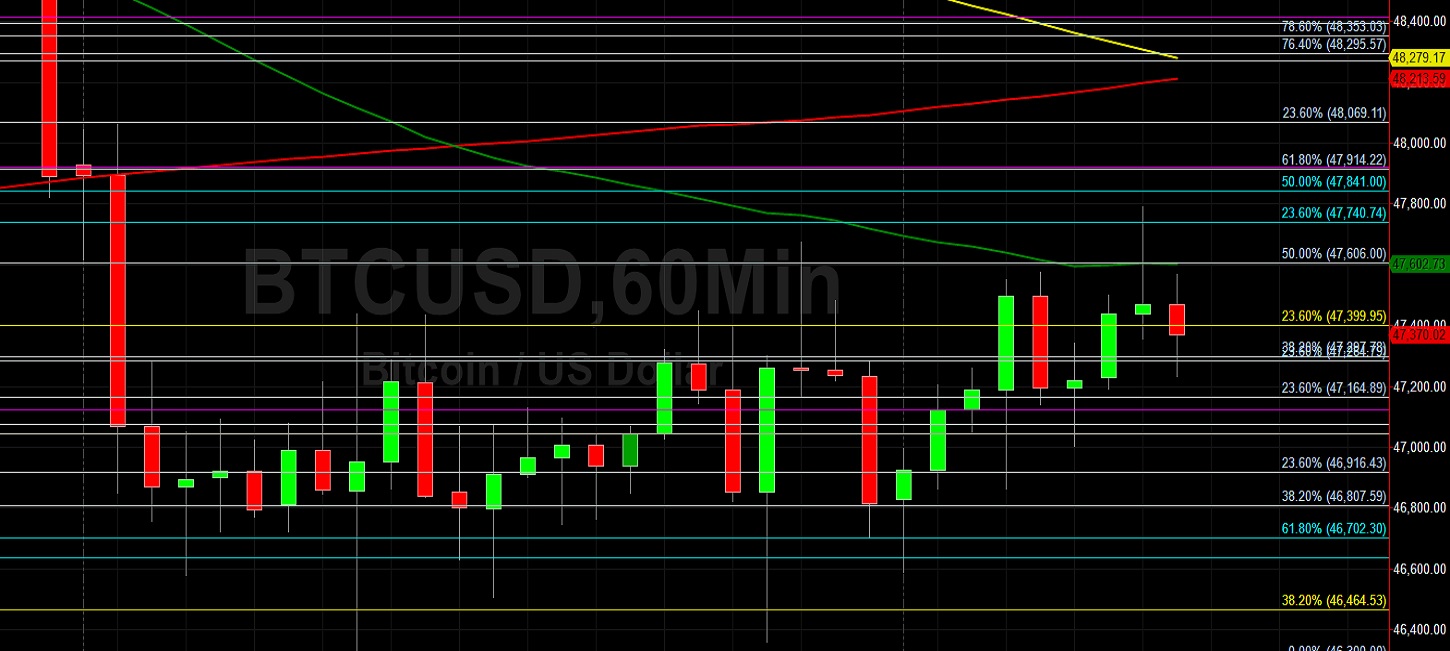

We interviewed, SpeculantX, an intra-day trader who is always on the hunt for small market impulses and intraday trends. Intra-day trading is a style that specializes in profiting off of small price changes and making a fast profit off reselling. A pure intraday trader like SpeculantX will make several trades each day—perhaps in the hundreds.

SpeculantX primarily utilizes the order book and order prints to study the order flow in a particular market, helping him to understand the buying and selling activity at any given time. He also monitors the support and resistance levels within each time frame and studies how the market behaves at these levels before deciding to enter a trade.

Another top-trader, Jonsnov, utilizes two trading methods to gain an edge in the tournament. Jonsnov relies on a long-term strategy that reflects his long-term views on a specific cryptocurrency. The other is a short-term strategy designed to capitalize on short-term market movements.

It is essential to find an approach that fits your personality, lifestyle, and risk tolerance. If you do not feel comfortable with a strategy, then chances are that it will not be successful for you.

2. Establish Risk Management Strategy

The top traders also mentioned the importance of risk control. Risk management helps reduce outsized losses. It can also help protect traders from losing all of their money. If the risk can be managed, traders can open themselves up to making money in the market.

SpeculantX, for example, is a firm believer in risk management and believes that it should be the foundation for any trader. In his journey to become a profitable trader, SpeculantX had suffered countless losing trades and mistakes, which has helped him develop a robust risk control foundation. Till today, he firmly believes that risk management is key to trading success.

There are several components to risk management. It is essential that you do not risk a significant portion of your capital in a trade. If the market goes unfavorably, the losses would not have a material impact on your account. It is also good practice to have a stop loss placed on each trade. If a stop loss is triggered, you must be disciplined and take the loss.

3. Master Your Trading Psychology

In the interviews, most of our top traders believe that a critical trait to becoming a successful trader is to master your trading psychology. Trading psychology refers to the emotional element that traders face when real money is on the line.

Jonsnov believes that a good trader should be patient and calm when trading. Traders must possess a strong mentality and must have a plan suitable for all market conditions. SpeculantX echoes this advice; he believes any aspiring intra-day trader must possess qualities such as perseverance, tolerance to stress, the ability to make informed trading decisions quickly, and competently work with risks.

To achieve long-term success as a trader, you need to learn to stay calm during trades and avoid emotional mistakes. It takes a lot of practice and effort. Thus, you’ve got to work on understanding trading psychology and guiding your mind to set yourself up for success.

4. Self-Confidence and Conviction

Trade conviction is what separates amateurs from pro traders. By definition, conviction is “a firmly held belief or opinion”. You will often hear pro traders say, “that was a conviction trade” in the trading world. Conviction trades often contribute the bulk of your profits when the market goes favorably.

Jonsnov shared with us how a conviction trade led him to his best trade ever. Jonsnov was an early adopter of BNB and became bullish on the crypto back when prices were as low as $17. Despite the naysayers, he held on to the trade with conviction and eventually exited his BNB position at $600 – over 3400% gain. To replicate such success, you must operate with conviction as you go about your business. When you place a trade, there should be no fear, hope, or self-doubt.

5. Leverage on Technology

In a fast-paced environment of cryptocurrency trading, opportunities are abundant, and they may appear in a split second. As such, leveraging technology can optimize your efficiency and ensure that your strategies are executed promptly while eliminating human error.

One of the most profitable teams in the tournament, 3Commas, utilizes trading bots to gain an edge against other competitors. 3Commas has an extensive set of tools that enable traders to execute the most profitable trading strategies. Connected with a reliable exchange like Binance, 3Commas’ tools make it possible to achieve great trading results. With their systematic trading approach, 4,056 traders united under the 3Commas banner took 5th place in the Futures Spring Tournament, beating 99% of other teams, including professional traders.

Another trader we interviewed also advocates automated trading, using robots instead of manual trading. Since all the rules of the strategy are programmed, automated trading eliminates impulsive trading behavior and emotions. The biggest advantage of automated trading is the sheer volume of trades that a machine can handle compared to a human. A computer can execute several trades in the span of microseconds across different crypto futures markets.

Once the trading parameters are in place, a trader does not have to monitor the markets continuously, and trading execution will be automated by the robot, freeing up time for traders.

Trading on a Top-Tier Platform

During the interviews, the traders discussed their trading experiences on Binance Futures and how it aided their success. They emphasized the importance of a safe, dependable, and industry-leading trading platform, especially in today’s volatile crypto market, which Binance Futures provided throughout the tournament.

One of the most appealing aspects of Binance Futures was its user-friendly platform. The traders said the platform was simple to use and that they liked the clean and simple user interface.

Furthermore, the traders mentioned that Binance Futures’ extensive crypto futures offering, which included a variety of futures contracts – perpetual and quarterly contracts – provided more trading opportunities to generate good returns. Binance offers a complete ecosystem to fully utilize crypto assets and manage risk in a cryptocurrency portfolio, thanks to the integration of Binance Spot and Futures markets.

The tournament stressed the importance of developing a strong trading community that will help us grow as a leading derivatives exchange. It also gave us the opportunity to get direct input from all participants about how to better the trading experience.

The recently concluded Futures Spring Tournament was a resounding success. Overall, the 15-day tournament attracted over 140,000 traders worldwide with over 580 participating teams. It was exciting to have traders of various backgrounds and experiences participate in the tournament to test their trading skills.

The tournament brought together some of the best crypto traders globally – all competing for the grand prize of $1.6 million worth of BNB.

As the tournament ended, we interviewed some of the top traders and learned the secrets to their trading success. Specifically, we learned more about their trading style, strategies, and their psychological approach to trading. Our top traders also shared their best and worst trading experiences in the interview, giving you an insight into the dos and don’ts of crypto trading. Without further ado, below are the main pieces of advice shared by the tournament’s top traders.

1. Develop Your Trading Methodology

Every trader is unique – each with its own methodologies, risk tolerance, and time horizons. All successful traders have a working method to analyze the markets – from intra-day trading to long-term position trading. In the interview with our top traders, we discovered that they have a well-defined trading methodology.

We interviewed, SpeculantX, an intra-day trader who is always on the hunt for small market impulses and intraday trends. Intra-day trading is a style that specializes in profiting off of small price changes and making a fast profit off reselling. A pure intraday trader like SpeculantX will make several trades each day—perhaps in the hundreds.

SpeculantX primarily utilizes the order book and order prints to study the order flow in a particular market, helping him to understand the buying and selling activity at any given time. He also monitors the support and resistance levels within each time frame and studies how the market behaves at these levels before deciding to enter a trade.

Another top-trader, Jonsnov, utilizes two trading methods to gain an edge in the tournament. Jonsnov relies on a long-term strategy that reflects his long-term views on a specific cryptocurrency. The other is a short-term strategy designed to capitalize on short-term market movements.

It is essential to find an approach that fits your personality, lifestyle, and risk tolerance. If you do not feel comfortable with a strategy, then chances are that it will not be successful for you.

2. Establish Risk Management Strategy

The top traders also mentioned the importance of risk control. Risk management helps reduce outsized losses. It can also help protect traders from losing all of their money. If the risk can be managed, traders can open themselves up to making money in the market.

SpeculantX, for example, is a firm believer in risk management and believes that it should be the foundation for any trader. In his journey to become a profitable trader, SpeculantX had suffered countless losing trades and mistakes, which has helped him develop a robust risk control foundation. Till today, he firmly believes that risk management is key to trading success.

There are several components to risk management. It is essential that you do not risk a significant portion of your capital in a trade. If the market goes unfavorably, the losses would not have a material impact on your account. It is also good practice to have a stop loss placed on each trade. If a stop loss is triggered, you must be disciplined and take the loss.

3. Master Your Trading Psychology

In the interviews, most of our top traders believe that a critical trait to becoming a successful trader is to master your trading psychology. Trading psychology refers to the emotional element that traders face when real money is on the line.

Jonsnov believes that a good trader should be patient and calm when trading. Traders must possess a strong mentality and must have a plan suitable for all market conditions. SpeculantX echoes this advice; he believes any aspiring intra-day trader must possess qualities such as perseverance, tolerance to stress, the ability to make informed trading decisions quickly, and competently work with risks.

To achieve long-term success as a trader, you need to learn to stay calm during trades and avoid emotional mistakes. It takes a lot of practice and effort. Thus, you’ve got to work on understanding trading psychology and guiding your mind to set yourself up for success.

4. Self-Confidence and Conviction

Trade conviction is what separates amateurs from pro traders. By definition, conviction is “a firmly held belief or opinion”. You will often hear pro traders say, “that was a conviction trade” in the trading world. Conviction trades often contribute the bulk of your profits when the market goes favorably.

Jonsnov shared with us how a conviction trade led him to his best trade ever. Jonsnov was an early adopter of BNB and became bullish on the crypto back when prices were as low as $17. Despite the naysayers, he held on to the trade with conviction and eventually exited his BNB position at $600 – over 3400% gain. To replicate such success, you must operate with conviction as you go about your business. When you place a trade, there should be no fear, hope, or self-doubt.

5. Leverage on Technology

In a fast-paced environment of cryptocurrency trading, opportunities are abundant, and they may appear in a split second. As such, leveraging technology can optimize your efficiency and ensure that your strategies are executed promptly while eliminating human error.

One of the most profitable teams in the tournament, 3Commas, utilizes trading bots to gain an edge against other competitors. 3Commas has an extensive set of tools that enable traders to execute the most profitable trading strategies. Connected with a reliable exchange like Binance, 3Commas’ tools make it possible to achieve great trading results. With their systematic trading approach, 4,056 traders united under the 3Commas banner took 5th place in the Futures Spring Tournament, beating 99% of other teams, including professional traders.

Another trader we interviewed also advocates automated trading, using robots instead of manual trading. Since all the rules of the strategy are programmed, automated trading eliminates impulsive trading behavior and emotions. The biggest advantage of automated trading is the sheer volume of trades that a machine can handle compared to a human. A computer can execute several trades in the span of microseconds across different crypto futures markets.

Once the trading parameters are in place, a trader does not have to monitor the markets continuously, and trading execution will be automated by the robot, freeing up time for traders.

Trading on a Top-Tier Platform

During the interviews, the traders discussed their trading experiences on Binance Futures and how it aided their success. They emphasized the importance of a safe, dependable, and industry-leading trading platform, especially in today’s volatile crypto market, which Binance Futures provided throughout the tournament.

One of the most appealing aspects of Binance Futures was its user-friendly platform. The traders said the platform was simple to use and that they liked the clean and simple user interface.

Furthermore, the traders mentioned that Binance Futures’ extensive crypto futures offering, which included a variety of futures contracts – perpetual and quarterly contracts – provided more trading opportunities to generate good returns. Binance offers a complete ecosystem to fully utilize crypto assets and manage risk in a cryptocurrency portfolio, thanks to the integration of Binance Spot and Futures markets.

The tournament stressed the importance of developing a strong trading community that will help us grow as a leading derivatives exchange. It also gave us the opportunity to get direct input from all participants about how to better the trading experience.

.

元ソース 詳細はこちら

5 Trading Secrets We Learned From Interviewing Futures Tournament’s Top Traders

バイナンス公式

バイナンス登録