原文(英)JPMorgan Thinks Bitcoin Is Overvalued at $44,000

2022-02-10 03:45:22

Key Takeaways

- Analysts at JPMorgan have estimated that Bitcoin’s “fair value” is $38,000, around 12% lower than its current price $44,000.

- The strategists noted that Bitcoin’s volatility is 300% higher than gold’s.

- JPMorgan has given a long-term price target of $150,000 for the asset.

Share this article

Analysts at JPMorgan Chase have estimated that the “fair value” for Bitcoin is $38,000, suggesting that the asset is overvalued by around 12%.

JPMorgan Shares Bitcoin Valuation Models

Despite its recent fall from all-time highs of over $69,000, some analysts at JPMorgan think Bitcoin is still overvalued at its current price of around $44,000.

Strategists at the investment banking behemoth, led by Nikolaos Panigirtzoglou, have Bitcoin’s “fair value” to be roughly $38,000, Bloomberg reported today. Panigirtzoglou and his team reached the finding after noting that Bitcoin is around 300% more volatile than gold.

In a research note published Tuesday, analysts claimed that Bitcoin’s fair value and volatility were inversely correlated. In other words, according to their metrics, if Bitcoin was less volatile, its fair value price would rise. The analysts suggested that if Bitcoin’s volatility differential relative to gold decreased to 200%, the asset’s fair value would be $50,000.

The strategists argued that Bitcoin’s biggest hurdle for the future is its “volatility and the boom and bust cycles,” characteristics they said have limited institutional adoption. Panigirtzoglou gave a long-term price target of $150,000 for the number one crypto, a slight increase on the $146,000 target he gave in January 2021.

JPMorgan has been relatively conservative when it comes to crypto forecasts in recent months. In June 2021, weeks after Bitcoin had experienced correction from its April high of $64,000, Panigirtzoglou called for lows of around $26,000 and said that the fair value was between $24,000 and $36,000. Bitcoin memorably hit a local bottom of around $29,000 over the summer before surging to $69,000 in November. It’s struggled to maintain highs since then.

Various factors have contributed to what’s been a rocky few months for the crypto market, including fears over Omicron and a potential Russian war, increased correlation with traditional assets, and the Federal Reserve’s planned interest rate hikes for 2022. In the research note, the JPMorgan analysts pointed to futures open interest and reserves on exchanges as evidence that the latest market decline could bring a “more long-standing and thus more worrisome position reduction trend” than the one the market saw in May 2021.

While JPMorgan may be forecasting a relatively scenario for Bitcoin, other analysts have shown more confidence in the asset in recent weeks. ARK Invest, the asset management firm run by Bitcoin believer Cathie Wood, said that Bitcoin could hit $1 million by 2030 in a report last month. Analysts stated that Bitcoin has seen a sharp increase in long-term investors and that adoption is growing at a rapid rate. The same report argued that Ethereum could become a $20 trillion network by the end of the decade, which would put ETH’s price at about $180,000.

Disclosure: At the time of writing, the author of this piece owned BTC, ETH, and several other cryptocurrencies.

Share this article

Bitcoin to M, Ethereum to 0,000 by 2030: ARK Report

In a new research report, American investment firm ARK Invest has shared bold price predictions for Bitcoin and Ethereum for the end of this decade. ARK Makes Bull Case for…

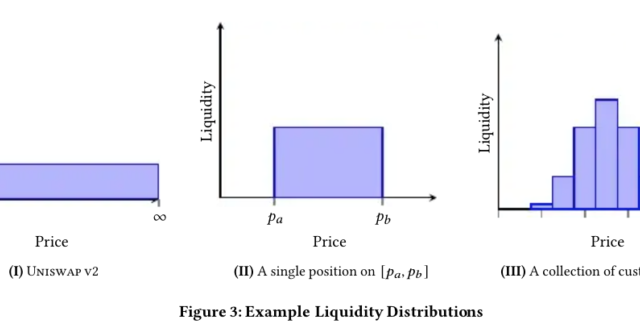

A Guide to Yield Farming, Staking, and Liquidity Mining

Yield farming is arguably the most popular way to earn a return on crypto assets. Essentially, you can earn passive income by depositing crypto into a liquidity pool. You can think of these liquidity…

Bitcoin Could Crash Further, Says JPMorgan

May 2021 was Bitcoin’s worst-performing month since 2011, but an analyst from American bank JPMorgan believes the asset could trend lower in the medium term. JPMorgan Turns Bearish JPMorgan strategist…

JPMorgan Lets Retail Wealth Clients Access Grayscale Products: Report

JPMorgan has become the first major bank to offer crypto access to retail wealth clients. JPMorgan Expands Crypto Access JPMorgan is doubling down on crypto. The American investment bank has…

元ソース