原文(英)Will investors see Tezos move past this resistance area

2022-02-11 06:30:25

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

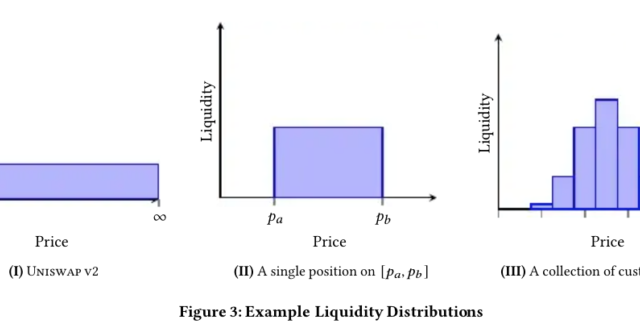

Since its ATH on 4 October, Tezos (XTZ) sharply downturned in a down-channel (yellow) over the last four months. During this phase, The 50 EMA (cyan) acted as strong resistance until the bulls flipped it to immediate support on 7 February.

If the price closes below the trendline resistance (white), it would confirm a hidden bearish divergence and would head to test the $3.8-level before continuing its uptrend trajectory. A compelling close above the 200 EMA would open up possibilities for price discovery. At press time, XTZ traded at $4.437, down by 1.8% in the last 24 hours.

XTZ Daily Chart

Source: TradingView, XTZ/USDT

The recent bearish phase saw a nearly 72.32% retracement as it snapped through numerous vital price levels. Thus, keeping the price below the 200 EMA and still depicting a slight bearish edge.

However, the last 13 days saw a staggering 77.3% revival from XTZ’z six-month low on 24 January. The force of this revival stemmed from many factors, one of them was the willingness of the buyers to show up at the six-month-long support trendline (white). During all the previous retests of this trendline, XTZ has managed to reverse its downtrend. Will it be able to repeat history?

The last two candlesticks found resistance at the upper band of the Bollinger Bands that also coincided with the 200 EMA resistance. On top of it, If the current candlestick closed below the trendline resistance (white), it would form a hidden bearish divergence. Hence, a possible retest of the $3.8 mark is likely before a down-channel breakout.

Rationale

Source: TradingView, XTZ/USDT

The RSI saw a rapid recovery as it rocketed towards its 4-month high on 9 February. However, it seemingly hinted at a hidden bearish divergence with the price action. The traders/investors need to keep a close watch on the 10 February candlestick to confirm this divergence.

Also, the MACD confirmed the increased bullish dominance, but its lines were yet to find a sustained close above the midline.

Conclusion

Considering the overbought readings and the possible bearish divergence with its RSI, a near-term setback until the $3.8-mark or its 20 EMA would be likely. Post that, the bulls will endeavor to trigger a breakout rally in the days to come.

Besides, Bitcoin’s movement and the overall market sentiment need to be factored in as a complementary tool to make an accurate decision.