Crypto futures and options offer unique benefits for traders, which accounts for their increasing growth in the trading world. While futures tend to be more cost-effective, options attract lesser risk. Your choice on either of the two will depend on your risk appetite and liquidity consideration.

Futures and options remain exciting trading instruments for crypto lovers. They allow speculations and calculated risks, thereby increasing the rate at which people trade crypto. In times past, trading seemed like an exclusive activity for financial experts. However, with instruments like futures and options, trading has become more mainstream and appealing.

Although the two instruments are both relevant in trading, they are not the same. Continue reading to learn more about their differences and mode of operation.

- What Are Crypto Futures?

- What Are Crypto Options?

- Futures’ Benefits And Differences

- How To Trade Crypto Futures Contracts

- How To Trade Crypto Options Contracts

- Conclusion

- What Are Crypto Futures?

- What Are Crypto Options?

- Futures’ Benefits And Differences

- How To Trade Crypto Futures Contracts

- How To Trade Crypto Options Contracts

- Conclusion

What Are Crypto Futures?

Suppose you’re looking to minimize volatility while taking advantage of price alterations. Crypto futures will be the smart choice for you. They are derivative products through which buyers and sellers agree to trade a crypto asset at a pre-established price and date.

The contracts you trade in the futures market do not carry the true value of the cryptocurrency you use. This means that you do not own the purchased cryptocurrency. Since you’re contracting on pre-established terms, a futures contract will not confer on you any economic benefit that ordinarily comes with buying cryptos.

Essentially, crypto futures trading rewards your speculation and allows you to trade with ease regardless of rising or falling prices. In other words, trading futures contracts are similar to placing bets because your predictions determine your overall reward.

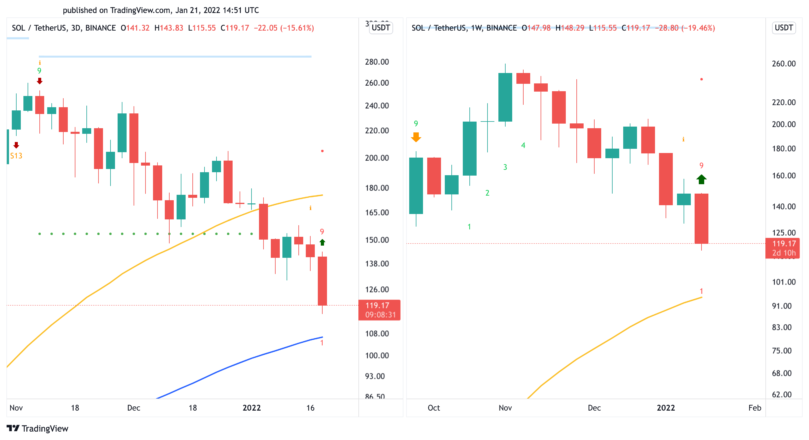

Depending on risk appetite and trading signals, participants can go long or short. You go long when you anticipate a price increase, while you go short when you expect a drop. Regardless of the direction, once the pre-agreed date comes, the contract expires, and the parties settle.

You will also gain access to leverage in most futures markets. Leverage is a strategy that allows you to trade futures contracts without having to pay upfront the full value of a contract. Traders can borrow the needed capital to finance the contract with a relatively smaller equity stake.

Types Of Crypto Futures Contract

An overview of the features and products of futures contracts will help you have a deft understanding. There are essentially two product lines for crypto futures that are accessible to users. These are:

-

USD-Margined Futures Contracts: USD-pegged coins are the native currency used in settling contracts of this nature. This futures type supports both delivery and perpetual contracts and offers leverage of up to 125x. By supporting perpetual contracts, participants can hold positions with no expiration date. Read more on USDT-Margined Futures Contracts.

-

Coin-Margined Futures Contracts: Although this product also supports both perpetual and delivery contracts, participants can quote and settle in numerous cryptocurrencies. Perpetual contracts under this product are also quick to maximize profit during bull runs. Read more on Coin-Margined Future Contracts.

What Are Crypto Options?

Crypto options are a form of derivative contract that provides the purchaser with the right to buy or sell an asset at a determined price and date. A “call” option refers to the buying right, while a “put” option connotes the selling right.

Options operate in a similar manner to other derivatives. It gives traders the avenue to predict and take advantage of price alterations. Traders can also settle in cryptocurrencies, just like futures contracts.

Participants trade crypto options because it offers them a comparatively low-risk and low-cost solution. This is especially the case when you consider options in relation to perpetual swaps and crypto futures.

Types of Crypto Options

You have two options types to determine your trade

-

Call: The right to buy an underlying asset.

-

Put: The right to sell an underlying asset.

Futures’ Benefits And Differences

Crypto futures and options both have benefits as well as differences. Knowing these benefits and differences informs the choices of traders on which to invest their money and why.

Cost-effective

The first thing to note is that crypto futures are cost-efficient. You do not have to pay a premium upfront before the issuance of the contract. This means reduced cost on your contracts without compromising your rewards if your prediction comes through. This is unlike crypto options, where you have to pay a premium to the seller in advance.

Notably, you may have to pay some commissions for crypto futures depending on the exchange with which you trade.

Time Resistance

Futures contracts do not suffer from time-decay. This means that time doesn’t adversely affect the valuation of the contract. Futures contracts will closely track the value of their underlying assets up till the expiration day. On the flip side, crypto options have to meet specific criteria for you to actualize their profits. More importantly, as the expiration date draws closer, they become less valuable. So, while futures contracts aren’t adversely affected by time, options are, since the passage of time impacts their value.

Size

The futures market is relatively old. As such, it has garnered several traders over the years, which now makes the market even larger. Consequently, it often holds higher volumes of traded cryptocurrencies than you will find anywhere else.

This is not the case with crypto options, which mostly comprise smaller contract units. Due to the expanse of the futures market, big market players and traders tilt towards it and have turned the markets into a highly potent trading ground.

High Liquidity

Since the futures market enjoys a larger space than the options market, it is more liquid and easily accessible than the other. The options market’s liquidity can be low, especially when big trades take a sizable time to settle.

Options’ Benefits and Differences

Reduced Loss and Lower Risk

Remember, futures contracts are valued beforehand and set for execution at a predetermined date. As such, they are riskier because there is no way to evaluate how much you’ll make or lose. This makes it challenging to manage your risks. However, with options, you can evaluate your loss beforehand, especially with long options where you’re aware of the premium prior to entering the trade. Long options positions are generally less risky than futures and short options positions. Since they give the trader an idea of the possible loss, they are less risky than futures contracts.

Execution Freedom

An options contract confers a right on the buyer and not an obligation. This means that a buyer has the will to buy the underlying asset when it’s most profitable to do so. Such an advantage doesn’t exist with futures contracts. Purchasing under a futures contract is an obligation.

Great Flexibility

Crypto options offer greater flexibility than futures contracts. Specifically, American-style options on Binance enable users to exercise their options at any time before the expiration date. This means that American-style options holders can capitalize on market opportunities quicker and realize their profits without any time restrictions.

In contrast, physically settled futures can only be exercised at the expiration date.

How To Trade Crypto Futures Contracts

The best way to enjoy futures trading is by using exchanges with simple and easy-to-use interfaces. Trading crypto futures on Binance makes the process seamless and convenient. The futures market offers you the opportunity to take advantage of market movements by going short or long in your contracts. You also have up to 125x leverage to expand your rewards in a volatile market.

You can trade futures contracts on Binance with the following steps:

-

Start by creating your futures account. After that, deposit the margin into your futures account. You may choose between USDT, BUSD, or any supported cryptocurrency in your account to be used as a margin.

-

Based on your preference, determine your leverage level. Consider the underlying asset’s volatility when choosing your leverage level.

-

Following that, you will choose the order form you intend to engage, whether buy or sell. Remember that “buy” relates to when you’re predicting an increase in price while “sell” has to do with anticipated decline.

-

Select the number of contracts you intend to own.

Futures contracts allow you to profit whether price decreases or increases. Suppose you’re going on long with a contract size of 1 BTC, you can set your entry price at $50,000 and exit price at $55,000, leaving you with a profit of $5,000.

If you were going short, it’s the other way round. That is, the entry point at $50,000, while the exit price will be $45,000, leaving you with a profit of $5,000. So, essentially, you can gain from the two ways an asset can possibly move.

How To Trade Crypto Options Contracts

Trading options on Binance is an easy process — All you need is to download the Binance app. Once done, you will need to activate your futures account and click on the Trades tab to choose “Options.”

-

Ensure to fund your futures wallet. You can do that by transferring funds from your spot wallet to your futures account.

-

For options, you can choose different time periods, such as 10-minute, 30, 1 hour, 8, and 1 day. These periods represent the expiration date of your trade.

-

Remember you have the put and call option, where call deals with an increase in anticipation, while put deals with a decrease. You can choose either of the two based on your preference and analysis.

-

Input the contract size

-

When you’re done, click to “buy call”, after which the premium will be deducted in USDT from your futures wallet.

-

You can use the “Positions” tab to monitor your open positions. It will also reflect the amount of time you have before the expiry time. So, suppose you want out, you can click to settle and close the position.

Conclusion

Trading crypto futures or options often depends on your preferences. However, an important factor to consider in trading is how to maximize profits. Crypto futures offer you a large market to trade in, while crypto options offer you a low-risk market. This makes it important that your predictions are based on adequate analysis. While you cannot determine market flow and volatility, you can mitigate your loss.

Note: Binance offers two types of options products: American-style options by Binance Futures and European-style vanilla options.

Crypto futures and options offer unique benefits for traders, which accounts for their increasing growth in the trading world. While futures tend to be more cost-effective, options attract lesser risk. Your choice on either of the two will depend on your risk appetite and liquidity consideration.

Futures and options remain exciting trading instruments for crypto lovers. They allow speculations and calculated risks, thereby increasing the rate at which people trade crypto. In times past, trading seemed like an exclusive activity for financial experts. However, with instruments like futures and options, trading has become more mainstream and appealing.

Although the two instruments are both relevant in trading, they are not the same. Continue reading to learn more about their differences and mode of operation.

What Are Crypto Futures?

Suppose you’re looking to minimize volatility while taking advantage of price alterations. Crypto futures will be the smart choice for you. They are derivative products through which buyers and sellers agree to trade a crypto asset at a pre-established price and date.

The contracts you trade in the futures market do not carry the true value of the cryptocurrency you use. This means that you do not own the purchased cryptocurrency. Since you’re contracting on pre-established terms, a futures contract will not confer on you any economic benefit that ordinarily comes with buying cryptos.

Essentially, crypto futures trading rewards your speculation and allows you to trade with ease regardless of rising or falling prices. In other words, trading futures contracts are similar to placing bets because your predictions determine your overall reward.

Depending on risk appetite and trading signals, participants can go long or short. You go long when you anticipate a price increase, while you go short when you expect a drop. Regardless of the direction, once the pre-agreed date comes, the contract expires, and the parties settle.

You will also gain access to leverage in most futures markets. Leverage is a strategy that allows you to trade futures contracts without having to pay upfront the full value of a contract. Traders can borrow the needed capital to finance the contract with a relatively smaller equity stake.

Types Of Crypto Futures Contract

An overview of the features and products of futures contracts will help you have a deft understanding. There are essentially two product lines for crypto futures that are accessible to users. These are:

-

USD-Margined Futures Contracts: USD-pegged coins are the native currency used in settling contracts of this nature. This futures type supports both delivery and perpetual contracts and offers leverage of up to 125x. By supporting perpetual contracts, participants can hold positions with no expiration date. Read more on USDT-Margined Futures Contracts.

-

Coin-Margined Futures Contracts: Although this product also supports both perpetual and delivery contracts, participants can quote and settle in numerous cryptocurrencies. Perpetual contracts under this product are also quick to maximize profit during bull runs. Read more on Coin-Margined Future Contracts.

What Are Crypto Options?

Crypto options are a form of derivative contract that provides the purchaser with the right to buy or sell an asset at a determined price and date. A “call” option refers to the buying right, while a “put” option connotes the selling right.

Options operate in a similar manner to other derivatives. It gives traders the avenue to predict and take advantage of price alterations. Traders can also settle in cryptocurrencies, just like futures contracts.

Participants trade crypto options because it offers them a comparatively low-risk and low-cost solution. This is especially the case when you consider options in relation to perpetual swaps and crypto futures.

Types of Crypto Options

You have two options types to determine your trade

-

Call: The right to buy an underlying asset.

-

Put: The right to sell an underlying asset.

Futures’ Benefits And Differences

Crypto futures and options both have benefits as well as differences. Knowing these benefits and differences informs the choices of traders on which to invest their money and why.

Cost-effective

The first thing to note is that crypto futures are cost-efficient. You do not have to pay a premium upfront before the issuance of the contract. This means reduced cost on your contracts without compromising your rewards if your prediction comes through. This is unlike crypto options, where you have to pay a premium to the seller in advance.

Notably, you may have to pay some commissions for crypto futures depending on the exchange with which you trade.

Time Resistance

Futures contracts do not suffer from time-decay. This means that time doesn’t adversely affect the valuation of the contract. Futures contracts will closely track the value of their underlying assets up till the expiration day. On the flip side, crypto options have to meet specific criteria for you to actualize their profits. More importantly, as the expiration date draws closer, they become less valuable. So, while futures contracts aren’t adversely affected by time, options are, since the passage of time impacts their value.

Size

The futures market is relatively old. As such, it has garnered several traders over the years, which now makes the market even larger. Consequently, it often holds higher volumes of traded cryptocurrencies than you will find anywhere else.

This is not the case with crypto options, which mostly comprise smaller contract units. Due to the expanse of the futures market, big market players and traders tilt towards it and have turned the markets into a highly potent trading ground.

High Liquidity

Since the futures market enjoys a larger space than the options market, it is more liquid and easily accessible than the other. The options market’s liquidity can be low, especially when big trades take a sizable time to settle.

Options’ Benefits and Differences

Reduced Loss and Lower Risk

Remember, futures contracts are valued beforehand and set for execution at a predetermined date. As such, they are riskier because there is no way to evaluate how much you’ll make or lose. This makes it challenging to manage your risks. However, with options, you can evaluate your loss beforehand, especially with long options where you’re aware of the premium prior to entering the trade. Long options positions are generally less risky than futures and short options positions. Since they give the trader an idea of the possible loss, they are less risky than futures contracts.

Execution Freedom

An options contract confers a right on the buyer and not an obligation. This means that a buyer has the will to buy the underlying asset when it’s most profitable to do so. Such an advantage doesn’t exist with futures contracts. Purchasing under a futures contract is an obligation.

Great Flexibility

Crypto options offer greater flexibility than futures contracts. Specifically, American-style options on Binance enable users to exercise their options at any time before the expiration date. This means that American-style options holders can capitalize on market opportunities quicker and realize their profits without any time restrictions.

In contrast, physically settled futures can only be exercised at the expiration date.

How To Trade Crypto Futures Contracts

The best way to enjoy futures trading is by using exchanges with simple and easy-to-use interfaces. Trading crypto futures on Binance makes the process seamless and convenient. The futures market offers you the opportunity to take advantage of market movements by going short or long in your contracts. You also have up to 125x leverage to expand your rewards in a volatile market.

You can trade futures contracts on Binance with the following steps:

-

Start by creating your futures account. After that, deposit the margin into your futures account. You may choose between USDT, BUSD, or any supported cryptocurrency in your account to be used as a margin.

-

Based on your preference, determine your leverage level. Consider the underlying asset’s volatility when choosing your leverage level.

-

Following that, you will choose the order form you intend to engage, whether buy or sell. Remember that “buy” relates to when you’re predicting an increase in price while “sell” has to do with anticipated decline.

-

Select the number of contracts you intend to own.

Futures contracts allow you to profit whether price decreases or increases. Suppose you’re going on long with a contract size of 1 BTC, you can set your entry price at $50,000 and exit price at $55,000, leaving you with a profit of $5,000.

If you were going short, it’s the other way round. That is, the entry point at $50,000, while the exit price will be $45,000, leaving you with a profit of $5,000. So, essentially, you can gain from the two ways an asset can possibly move.

How To Trade Crypto Options Contracts

Trading options on Binance is an easy process — All you need is to download the Binance app. Once done, you will need to activate your futures account and click on the Trades tab to choose “Options.”

-

Ensure to fund your futures wallet. You can do that by transferring funds from your spot wallet to your futures account.

-

For options, you can choose different time periods, such as 10-minute, 30, 1 hour, 8, and 1 day. These periods represent the expiration date of your trade.

-

Remember you have the put and call option, where call deals with an increase in anticipation, while put deals with a decrease. You can choose either of the two based on your preference and analysis.

-

Input the contract size

-

When you’re done, click to “buy call”, after which the premium will be deducted in USDT from your futures wallet.

-

You can use the “Positions” tab to monitor your open positions. It will also reflect the amount of time you have before the expiry time. So, suppose you want out, you can click to settle and close the position.

Conclusion

Trading crypto futures or options often depends on your preferences. However, an important factor to consider in trading is how to maximize profits. Crypto futures offer you a large market to trade in, while crypto options offer you a low-risk market. This makes it important that your predictions are based on adequate analysis. While you cannot determine market flow and volatility, you can mitigate your loss.

Note: Binance offers two types of options products: American-style options by Binance Futures and European-style vanilla options.

.

元ソース 詳細はこちら

Crypto Futures vs. Options – How Do They Differ?

バイナンス公式

バイナンス登録